Streamlined HUD Solution – System has HUD Structures Built-in

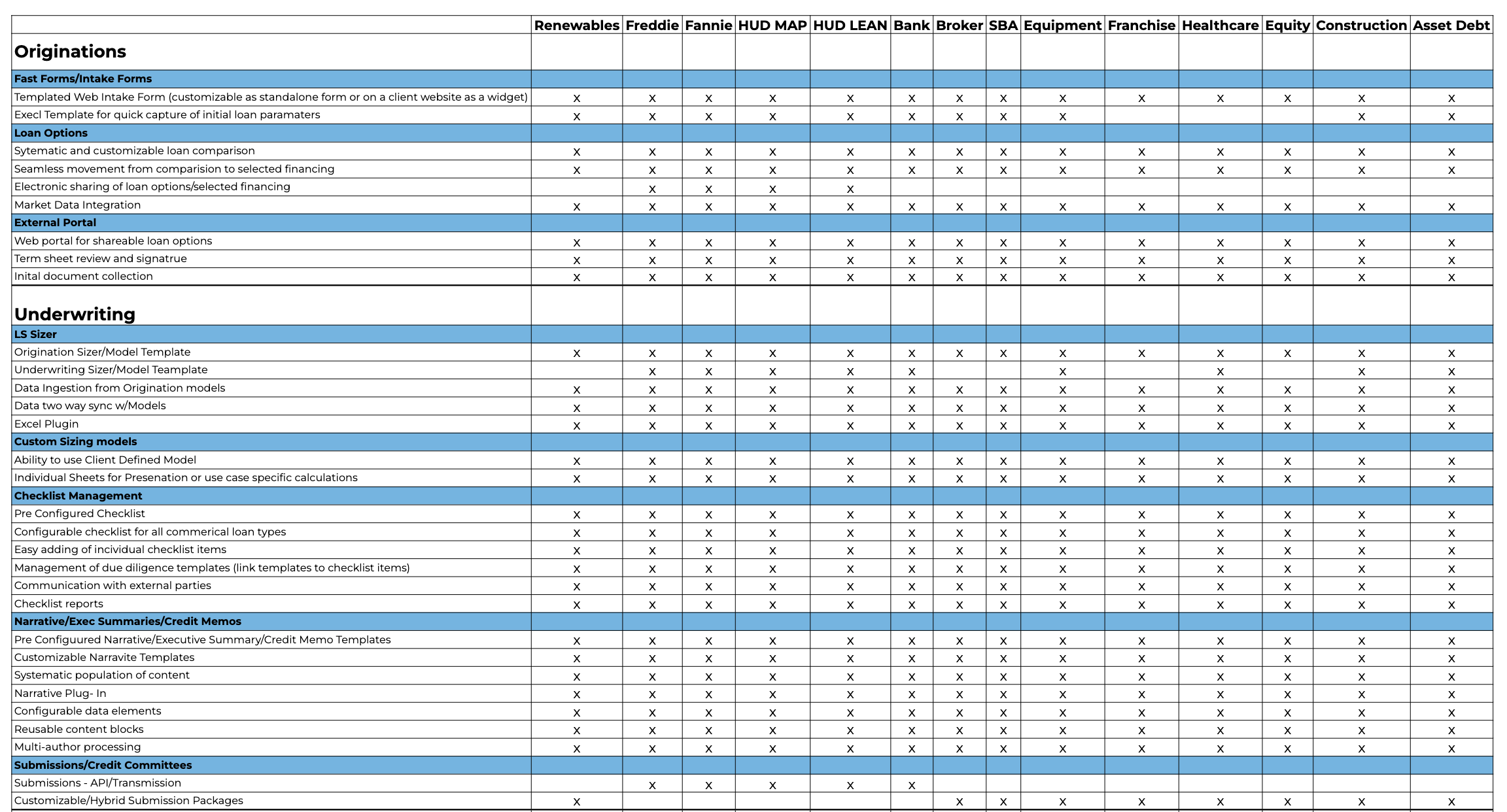

Our purpose-built, preconfigured (out of the box) HUD MAP and LEAN modules are the most comprehensive in the industry. The system knows all the documents, checklists, numbering schemes, and packaging structures required by HUD with enough flexibility to meet regional HUD requirements as well.

Leverage our purpose-built MAP & LEAN models or use your own.

Our modern platform and new cutting-edge MS plugins allow us to use many different models in the same loan process. We provide a best practice model for a formal MAP & LEAN underwriting process. The system also allows for the client’s pricing/production sizers to be the source into the system, with data being populated bi-directionally. This origination model’s data is then auto-populated into the formal sizer for the final and complex analysis pricing by Underwriters.

Leverage our purpose-built MAP & LEAN models or use your own.

Our modern platform and new cutting-edge MS plugins allow us to use many different models in the same loan process. We provide a best practice model for a formal MAP & LEAN underwriting process. The system also allows for the client’s pricing/production sizers to be the source into the system, with data being populated bi-directionally. This origination model’s data is then auto-populated into the formal sizer for the final and complex analysis pricing by Underwriters.

HUD MAP

LendingStandard’s Excel-based loan sizing engine supports all HUD MAP loan types: 223(f), 223 Heavy f, 221(d)(4), 223(a)(7). Our software automates the creation of consistent documents, including:

HUD LEAN

Our sizer tool and portfolio analysis tools also support HUD LEAN 232 loans, and our commercial lending platform can produce and organize the documents needed for the LEAN application process, including:

Elevate Efficiency with LendingStandard

We recognize your commitment to creating robust, affordable communities throughout the US. That’s why we introduced LendingStandard – to simplify the loan application process for you, enabling you to concentrate on your core expertise rather than getting bogged down in intricate details.

Ultimately, our motivation is clear: to offer HUD lenders a software that genuinely transforms your business operations and enhances your overall well-being.

Transforms Loan Processes with Automation

Originators and underwriters should be free from navigating complex processes. With LendingStandard, experience not only monetary savings but also enhanced quality and transparency throughout. Our automated loan completion process minimizes discrepancies, simplifies complexities, and boosts loan completions, saving both time and money.

Transforms Loan Processes with Automation

Originators and underwriters should be free from navigating complex processes. With LendingStandard, experience not only monetary savings but also enhanced quality and transparency throughout. Our automated loan completion process minimizes discrepancies, simplifies complexities, and boosts loan completions, saving both time and money.

Learn How We Have Helped Leading Organizations Grow

Case Study:

Centralized tool brings consistency and efficiency to the lending process

CHALLENGE: Regions Financial Corporation, one of the nation’s largest full-service providers of consumer and commercial banking, wealth management, and mortgage products and services, was looking to standardize their FHA/HUD financing and enhance their efficiency, quality and loan process transparency Underwriters at Regions found it difficult to manage their pipeline and keep track of each deal’s progress. Their efforts were hampered by a decentralized system of models and forms, many of which were manually built. They aimed to find a single solution that would give them the tools they needed to be competitive.

SOLUTION: Regions began phasing in LendingStandard’s leading-edge underwriting platform for newly engaged loans in early 2020, and quickly realized the benefits of the intuitive, centralized tool. As Chasteen’s team became “busier than we ever have been” with counter-cyclical HUD investing, LendingStandard continually made improvements – both small and large – to the platform that further supported the underwriting process. Alongside planned improvements, the LendingStandard team was quick to address any issues that Regions experienced. “Communication and responsiveness, that’s always been great,” Chasteen shared.

RESULTS: LendingStandard has “created better processes within our HUD platform,” said Chasteen. The most significant positive change Chasteen has seen so far is increased consistency across all deals in the pipeline, from automated document assembly to a checklist that tracks every vital step in the loan process. Though this consistency mainly benefits his team of underwriters as they size loans, create documents and manage their tasks, Chasteen doesn’t discount the time and effort it saves him in pipeline management: “Just having everything in one place, it’s a lot easier to keep track of what everybody’s working on.”

Let’s Expedite Your Loan Process

Are you tired of navigating the complexities of commercial lending?

Imagine a platform that streamlines every step, from loan capture to closing. A tool that offers real-time insights, seamless collaboration, and the ability to manage all of your loans in one place.

Take your commercial endeavors to the next level. Join our platform today and redefine efficiency in your operations.