Streamlined Broker/Partner Solution

Brokers occupy a unique space in the Commercial Lending industry, taking loan transactions all the way from borrower relationship to, in some cases, pre-underwriting, or any point in-between. The LendingStandard platform can manage all aspects of a broker’s needs relative to the loan origination and serve as a single source of truth for all open loans across multiple lender relationships.

Elevate Efficiency with LendingStandard

We recognize your commitment to creating robust, affordable , reusable, clean financial offerings throughout the US. That’s why we introduced LendingStandard – to simplify the complex loan processes for you, enabling you to concentrate on your core expertise rather than getting bogged down in intricate details.

Ultimately, our motivation is clear: to offer lenders a purpose-built platform that genuinely transforms your business operations and enhances your overall well-being.

Transforms Loan Processes with Automation

Originators and underwriters should be free from navigating complex processes. With LendingStandard, experience not only monetary savings but also enhanced quality and transparency throughout. Our automated loan completion process minimizes discrepancies, simplifies complexities, and boosts loan completions, saving both time and money.

Transforms Loan Processes with Automation

Originators and underwriters should be free from navigating complex processes. With LendingStandard, experience not only monetary savings but also enhanced quality and transparency throughout. Our automated loan completion process minimizes discrepancies, simplifies complexities, and boosts loan completions, saving both time and money.

Next Level Commercial Lending Platform

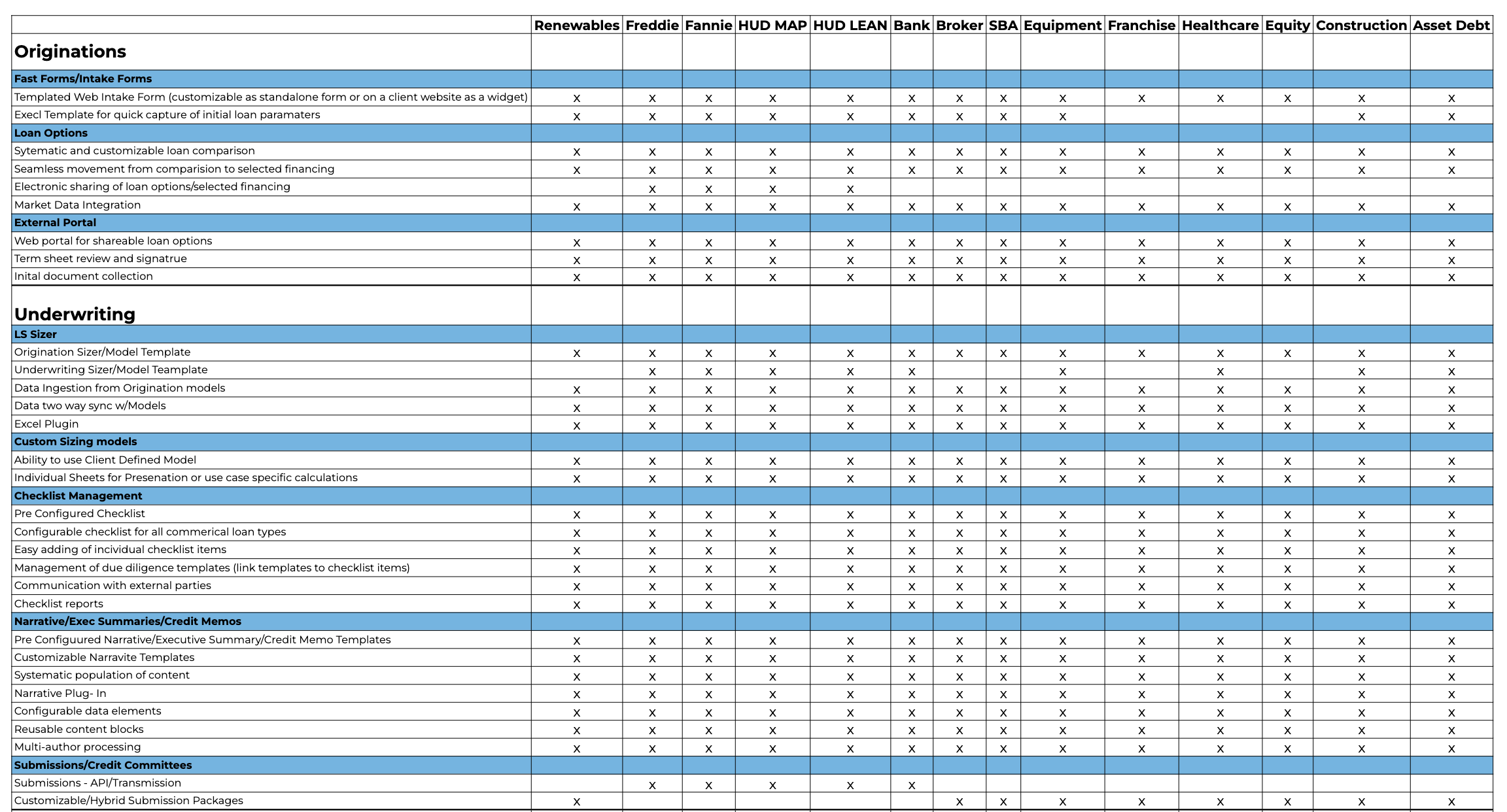

Optimize the commercial loan origination, underwriting and closing with:

Ensure consistency in sizing and analysis, from initial pricing to closing, with no repeated data entries.

Easily transition working files between originators and underwriters with a single click.

Stay updated with real-time views of checklist modifications by staff and third parties.

Streamline document sharing on one platform, minimizing emails and redundant requests.

Populate and organize data effortlessly, generating superior narrative documents and necessary forms.

Accelerate the loan committee approval process.

Monitor tasks and progress efficiently using workflows.

Get a comprehensive overview of your complete loan portfolio.

Learn How We Have Helped Leading Organizations Grow

Case Study:

Centralized tool brings consistency and efficiency to the lending process

CHALLENGE: Regions Financial Corporation, one of the nation’s largest full-service providers of consumer and commercial banking, wealth management, and mortgage products and services, was looking to standardize their FHA/HUD financing and enhance their efficiency, quality and loan process transparency Underwriters at Regions found it difficult to manage their pipeline and keep track of each deal’s progress. Their efforts were hampered by a decentralized system of models and forms, many of which were manually built. They aimed to find a single solution that would give them the tools they needed to be competitive.

SOLUTION: Regions began phasing in LendingStandard’s leading-edge underwriting platform for newly engaged loans in early 2020, and quickly realized the benefits of the intuitive, centralized tool. As Chasteen’s team became “busier than we ever have been” with counter-cyclical HUD investing, LendingStandard continually made improvements – both small and large – to the platform that further supported the underwriting process. Alongside planned improvements, the LendingStandard team was quick to address any issues that Regions experienced. “Communication and responsiveness, that’s always been great,” Chasteen shared.

RESULTS: LendingStandard has “created better processes within our HUD platform,” said Chasteen. The most significant positive change Chasteen has seen so far is increased consistency across all deals in the pipeline, from automated document assembly to a checklist that tracks every vital step in the loan process. Though this consistency mainly benefits his team of underwriters as they size loans, create documents and manage their tasks, Chasteen doesn’t discount the time and effort it saves him in pipeline management: “Just having everything in one place, it’s a lot easier to keep track of what everybody’s working on.”

Let’s Expedite Your Loan Process

Are you tired of navigating the complexities of commercial lending?

Imagine a platform that streamlines every step, from loan capture to closing. A tool that offers real-time insights, seamless collaboration, and the ability to manage all of your loans in one place.

Take your commercial endeavors to the next level. Join our platform today and redefine efficiency in your operations.