Unlock the Power of DealDoc.AI Today

Transform your lending operations with DealDoc.AI’s advanced analytics and seamless integration. Stay ahead of the competition and make smarter, data-driven decisions effortlessly. Contact us to schedule a demo or learn more about how DealDoc.AI can benefit your institution.

/01

DealDoc.AI – The power of AI to speed up your lending process

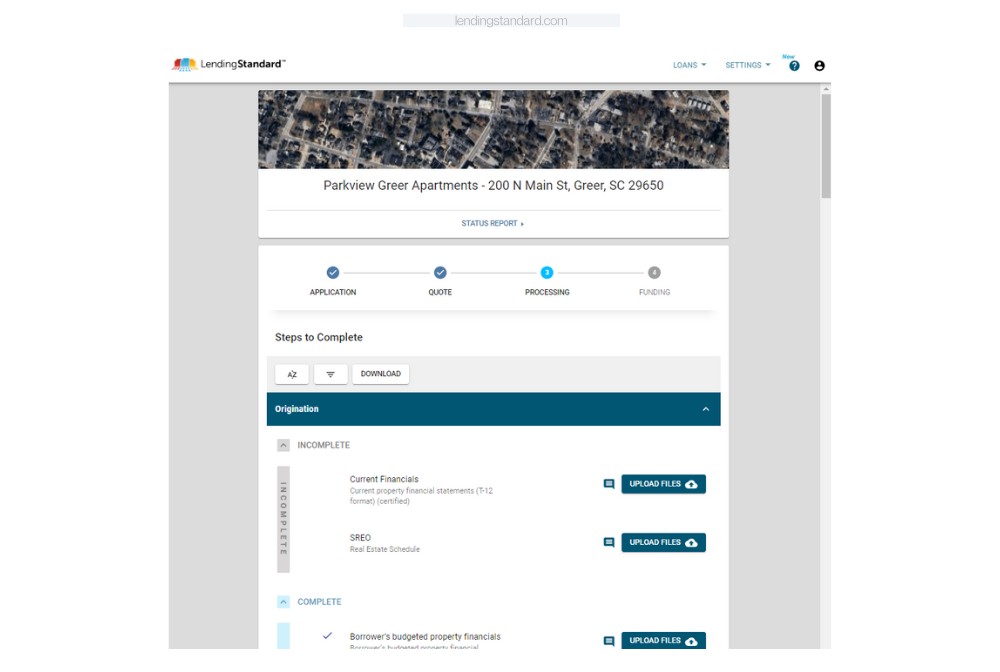

AI Powered Borrower Portal

Enhance your commercial lending experience with our secure third-party portal, offering clients fast access to documents and loan status, while seamlessly enabling document uploads and retrieval.

Enhanced 3rd Party Interface. Our advanced secure third-party portal is designed to streamline and enhance the client experience. This user-friendly portal provides your clients with quick and easy access to essential documents and real-time updates on their loan status, ensuring they are always informed and engaged.

Automated Document Collection. Our portal facilitates efficient document management, allowing clients to upload necessary paperwork and retrieve important files with ease. This seamless integration of document handling and status tracking not only improves client satisfaction but also accelerates the lending process by reducing delays and manual tasks.

Robust Security. You can trust that all data and communications are protected, maintaining the confidentiality and integrity of sensitive information. By leveraging our secure portal, you simplify the administrative aspects of commercial lending, boost operational efficiency, and deliver a superior, more responsive client experience.

/02

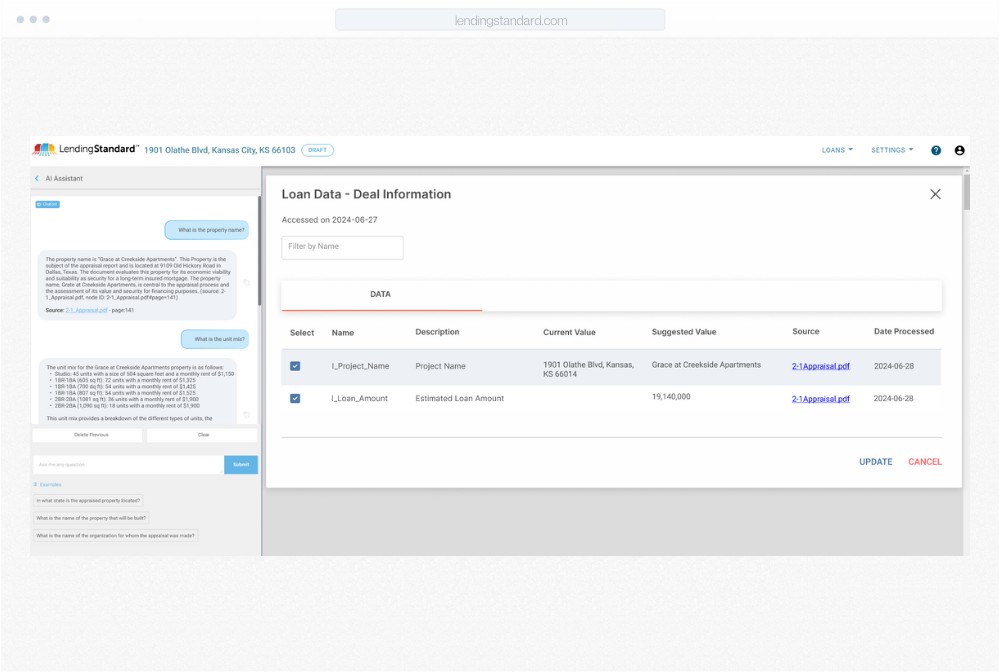

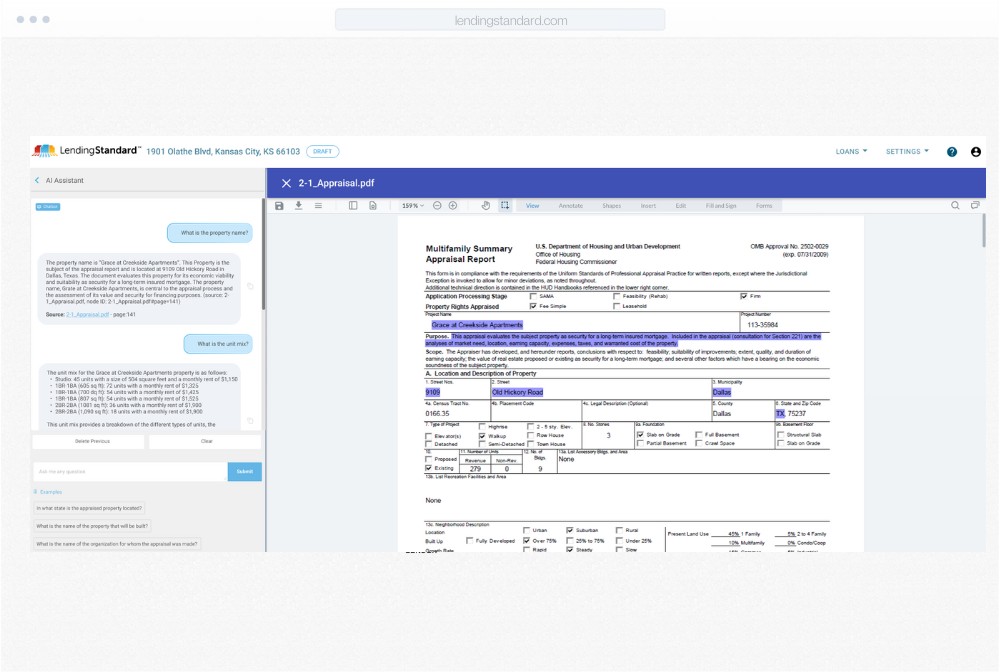

Talk to the Loan application and supporting documents

Unlock the full potential of your data with DealDoc.AI seamlessly integrated into LendingStandard.

Document Data Extract. DealDoc.AI can extract relevant information from loan applications and analyze unstructured customer communications data, making the process more efficient and user-friendly. With DealDoc.AI’s powerful tools, you gain access to real-time insights that are critical for various aspects of your operations.

Actionable Insights. DealDoc.AI enhances your team’s ability to quickly evaluate and gather the necessary information to execute on a loan. By collecting all data points, our AI-driven tools can deliver precise and actionable insights, supporting better-informed lending decisions.

Faster Decisioning. Leveraging LendingStandard/DealDoc.AI transforms how you handle data, enabling faster decision-making and more effective risk management. Embrace a future where real-time analysis and advanced AI capabilities streamline your processes and bolster your institution’s security and efficiency.

/03

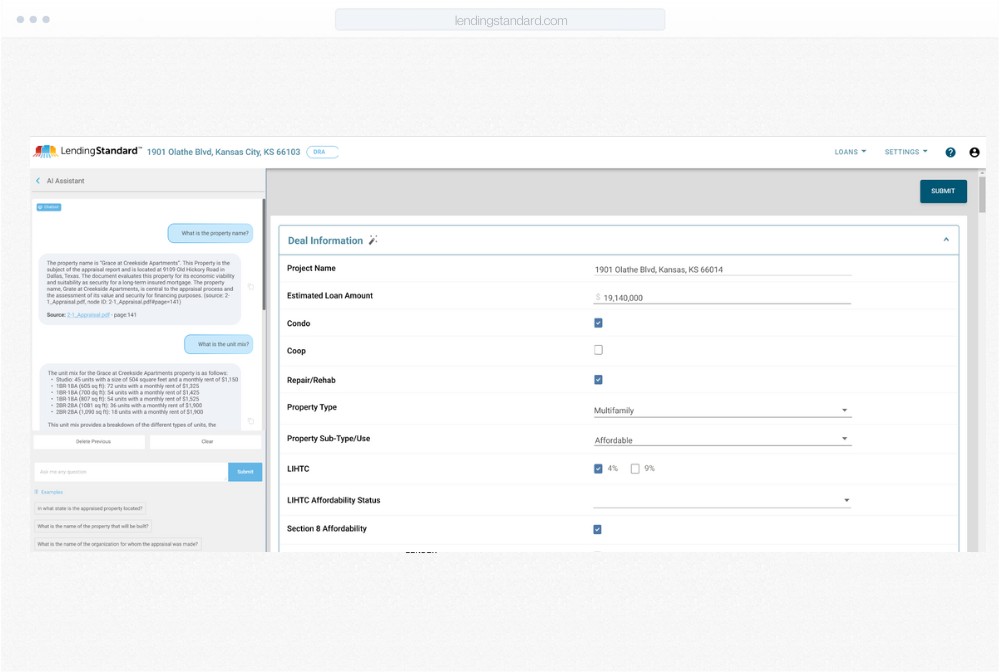

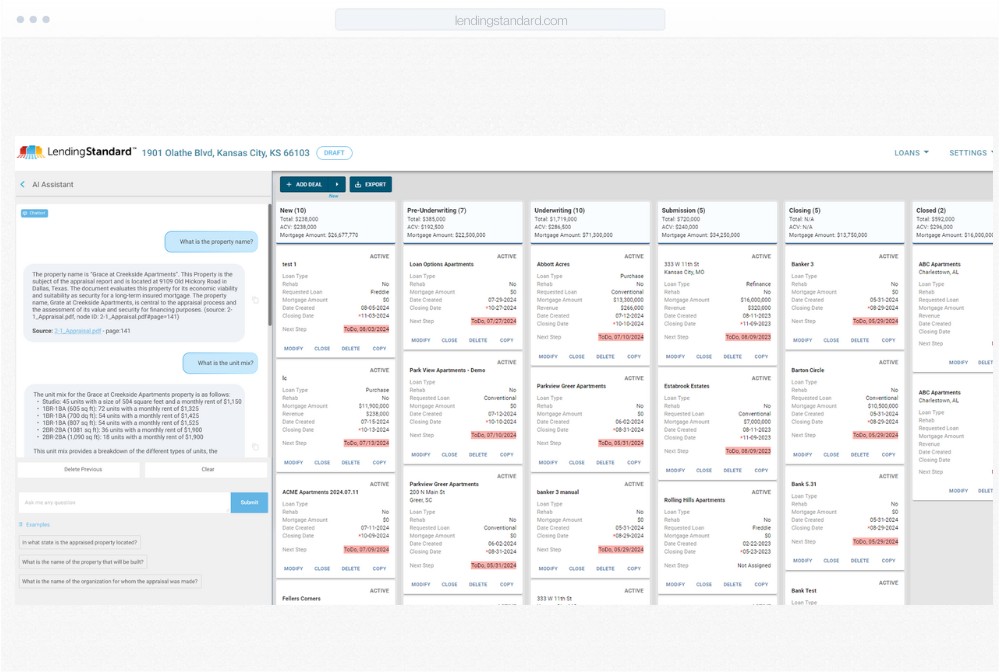

Take away manual data entry and analysis

In commercial loan origination, AI can significantly reduce costs, streamline processes, and enhance decision-making and risk analysis. Transitioning from manual to AI-driven processes boosts efficiency, reduces human error, and enhances the customer experience.

Empower Your Staff. Many banks use digital information systems but still depend on manual data entry and analysis, which can divert valuable employee time.

Reduce Manual Tasks. DealDoc.AI automates the extraction and aggregation of data, systematically manages and updates checklists, and generates essential documents with precision and speed. This automation not only enhances operational efficiency but also minimizes human error, ensuring that tasks are completed accurately and consistently.

Boost Your Effectiveness. By integrating DealDoc.AI’s workflow tools, you streamline your processes, boost productivity, and enhance overall business performance, creating a more agile and responsive organization.

/04

Automate Covenant Monitoring

Stay compliant with the latest loan covenants using DealDoc.AI’s automated monitoring. Identify and mitigate risks with ongoing loan interrogation, enhancing audit capabilities with minimal overhead.

Stay Ahead of the Risks. Ensure your institution remains compliant with the latest loan covenants effortlessly with BankerAI’s automated monitoring solutions. Our advanced AI tools are capable of tracking and analyzing loan agreements, helping you stay up-to-date with evolving regulatory requirements and internal policies.

Actively Monitor Loan Covenants. DealDoc.AI can provide loan interrogation, enabling you to swiftly identify and address potential risks. This proactive approach allows you to detect issues early, ensuring that any compliance gaps are managed before they escalate into more significant problems.

Cut Through the Clutter. Additionally, our solution enhances your audit capabilities by providing detailed, accurate reports with minimal overhead. The automation reduces the manual workload associated with compliance checks and audit preparation, allowing your team to focus on strategic tasks and in-depth analysis.

/05

Secure AI Application

Protect your institution from risks with DealDoc.AI’s secure AI tools. LendingStandard ensures safe use of advanced AI, improving workflow efficiency while safeguarding client data.

Secure Tools. DealDoc.AIs cutting-edge secure AI tools offer a comprehensive solution that ensures the safe and responsible use of advanced AI technologies by your staff. By integrating these tools into your eco-system, you can enhance workflow efficiency and streamline processes while maintaining the highest standards of data security.

Secure Data. LendingStandards solutions are designed to safeguard client data through robust protection measures, including stringent data access controls and encryption protocols. Our AI tools not only optimize your lending processes but also ensure that your clients’ personal and financial information is protected.

Unlock the Power of DealDoc.AI Today

Transform your lending operations with DealDoc.AI’s advanced analytics and seamless integration. Stay ahead of the competition and make smarter, data-driven decisions effortlessly. Contact us to schedule a demo or learn more about how BankerAI can benefit your institution.